Who Is Robert Kiyosaki and Why Does He Matter?

The Robert Kiyosaki Philosophy . Robert Kiyosaki stands as one of the most provocative and influential financial educators of our time. A former Marine Corps officer and salesman, Kiyosaki catapulted to global fame with his 1997 bestselling book Rich Dad Poor Dad, which has since become synonymous with challenging conventional wisdom about money, work, and investing. He matters not merely because of his commercial success but because he has fundamentally shifted the conversation around personal finance for millions. Where traditional advice often centers on getting a good job, saving money, and avoiding debt, Kiyosaki’s core message disrupts this narrative entirely. He argues that the standard path is designed to keep people in the “rat race,” working for money instead of having money work for them. His teachings, delivered through books, the Rich Dad brand, board games, and seminars, emphasize financial literacy, asset acquisition, and entrepreneurial mindset as the true vehicles to wealth. While often controversial and frequently criticized by mainstream financial planners, his enduring relevance lies in his ability to make people question the foundational beliefs they hold about money. He matters because he provides a stark, alternative framework for building wealth, one that prioritizes financial intelligence over formal education and courage over comfort. The Robert Kiyosaki Philosophy

The Foundational Dichotomy: Rich Dad vs. Poor Dad

At the very heart of Robert Kiyosaki’s entire body of work lies the powerful allegory of his two dads. This dichotomy is not just a storytelling device; it’s the central framework for his financial philosophy. His “poor dad”—his biological father, a highly educated university professor—represented the traditional path: excel in school, get a secure job with benefits, work hard for a steady paycheck, save diligently, and avoid financial risk. Despite a strong income, his poor dad often struggled with money. In stark contrast, his “rich dad”—the father of his best friend, a businessman who never finished the eighth grade—embodied a different set of principles. Rich dad believed in mastering money, understanding how it works, and making it serve him. He focused on acquiring income-generating assets, understanding tax laws, and building businesses. Poor dad would say, “I can’t afford it,” which shut down his mind to possibilities. Rich dad would ask, “How can I afford it?”—a question that forced him to think creatively and seek solutions. This juxtaposition is the ultimate lesson in mindset. It illustrates that financial struggle or success is less about the amount of money one earns and almost entirely about what one knows about money and the financial habits one cultivates. The rich dad vs. poor dad story powerfully demonstrates that the gap between being rich and being poor is primarily a gap in financial education and perspective.

A visual representation of the core idea behind Kiyosaki’s most famous work. The Robert Kiyosaki Philosophy

Debunking the Myth: Your House Is Not an Asset

Perhaps Robert Kiyosaki’s most controversial and pivotal teaching is his radical redefinition of the word “asset.” In direct opposition to common parlance, Kiyosaki asserts that your primary residence is a liability, not an asset. Traditional thinking celebrates homeownership as the ultimate financial milestone, the cornerstone of the “American Dream.” Kiyosaki turns this notion on its head. His definition is starkly functional: an asset is something that puts money in your pocket. A liability is something that takes money out of your pocket. Examine a typical family home through this lens. It generates no rental income; instead, it demands a mortgage payment, property taxes, insurance, maintenance, and utilities—a constant outflow of cash. Therefore, it qualifies as a liability. This is a profound mental shift. He is not saying never buy a house to live in; he advises to understand it for what it is—a lifestyle expense—and to focus first on acquiring true assets that generate enough cash flow to cover your liabilities, including your mortgage. This principle forces a reevaluation of personal balance sheets. Many people load up on what they think are assets—cars, boats, large houses—only to find themselves “cash poor,” with their income devoured by liabilities. By adopting this stricter definition, you begin to filter every purchasing decision through a new question: “Is this putting money in my pocket or taking it out?” This clarity is the first, crucial step toward building genuine wealth, and so on it fundamentally changes how one approaches personal finance from the ground up. The Robert Kiyosaki Philosophy

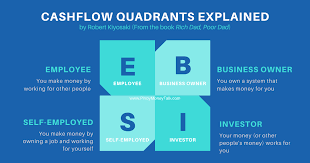

The Cashflow Quadrant: Mapping Your Path to Financial Freedom

Robert Kiyosaki provides a masterful map of the economic world with his Cashflow Quadrant, a simple yet profound diagram that categorizes all money-earning methods into four sections: E (Employee), S (Self-Employed/Small Business Owner), B (Big Business Owner), and I (Investor). The left side of the quadrant (E and S) is where you trade time for money. The Employee seeks security and a predictable paycheck, while the Self-Employed person seeks independence and control, often becoming their own best worker. The critical limitation for both is that their income is directly tied to their personal labor; if they stop working, the money stops. The right side of the quadrant (B and I) is where true wealth and freedom are built. The Big Business Owner owns a system that works for them, leveraging the time and effort of other people. The Investor makes money work for them through assets like stocks, real estate, and intellectual property. Kiyosaki’s core argument is that financial freedom is not about what you do, but about which quadrant you generate your income from. The journey from the left side to the right side is a journey of mindset, skills, and financial education. It involves moving from seeking security to embracing calculated risk, from being a specialist to being a system builder, and from working for money to having money and systems work for you. Understanding where you are in the quadrant and consciously charting a course to the B and I side is the essence of the Kiyosaki strategy for escaping the rat race. The Robert Kiyosaki Philosophy

| Quadrant | Mindset | Primary Income Source | Key Motivation |

|---|---|---|---|

| E – Employee | “I need a safe, secure job with benefits.” | Salary/Wage | Security |

| S – Self-Employed | “If you want it done right, do it yourself.” | Personal Profit | Control/Independence |

| B – Business Owner | “I need to find and lead the right people.” | System Profit | Leverage/Growth |

| I – Investor | “Where should I put my money to work?” | Investment Returns | Freedom/Passive Income |

The Critical Importance of Financial Literacy

For Robert Kiyosaki, financial literacy is not an elective subject; it is the most vital skill set for surviving and thriving in the modern world. He laments that this education is absent from traditional schooling, which instead prepares people to be good employees on the left side of the Cashflow Quadrant. True financial literacy, in his view, revolves around understanding four key areas: accounting, investing, understanding markets, and the law. It’s the ability to read and understand financial statements—the Income Statement (which shows profit and loss) and the Balance Sheet (which shows assets and liabilities). This literacy allows you to tell the financial story of any entity, be it a business, a property, or your own life. Without it, you are financially blind, relying on the advice of others who may not have your best interests at heart. Investing literacy means understanding the different asset classes and how they generate returns. Market literacy involves understanding the forces of supply and demand. Legal literacy encompasses knowledge of tax advantages, corporate structures, and protection strategies. Kiyosaki argues that the rich get richer primarily because they understand these concepts and use them to their advantage. They know how to use debt as leverage, how to legally minimize taxes through corporate vehicles, and how to identify a genuine asset from a disguised liability. For the average person, developing this literacy is the non-negotiable first step. It transforms money from a mysterious, stressful topic into a game with clear rules that you can learn to play and win. The Robert Kiyosaki Philosophy

The Power of Mindset: From Employee to Investor

Transitioning from the mindset of an employee or self-employed individual to that of a business owner or investor is the single greatest hurdle on the path to financial freedom, according to Kiyosaki. The employee mindset is conditioned for security and fear. It avoids risk, fears mistakes, and is comforted by a predictable paycheck. The investor mindset, however, is trained for opportunity and education. It understands that calculated risks are necessary, views mistakes as priceless lessons, and is motivated by freedom, not security. This shift is psychological and emotional before it is financial. Kiyosaki emphasizes that you must think like a rich person before you can become one. This involves changing your internal dialogue. Instead of saying “I can’t afford that,” you ask “How can I afford that?” This opens your mind to creative solutions and opportunities. Instead of seeing a lack of money as a barrier, you see it as a need for more financial education. Instead of working for money out of fear of not having enough, you learn to have money work for you out of a vision of abundance. This mindset values learning over earning in the short term. It seeks out mentors, devours financial information, and is willing to step outside its comfort zone. It embraces failure as part of the learning process. Cultivating this investor mindset is a daily practice of repatterning your thoughts about money, risk, and possibility. It is the invisible foundation upon which all tangible wealth is built. The Robert Kiyosaki Philosophy

A conceptual image representing the different paths to generating income. short paragraph The Robert Kiyosaki Philosophy

Assets vs. Liabilities: The Core Distinction

We touched on this earlier, but the asset vs. liability distinction is so critical to Kiyosaki’s teachings that it demands its own deep dive. This is the fundamental building block of his entire financial framework. An asset, by Kiyosaki’s unwavering definition, is anything that puts money into your pocket. It generates positive cash flow. Examples include rental properties where the income exceeds all expenses, dividend-paying stocks, bonds, royalties from intellectual property (like a book or patent), and a business that operates profitably without your day-to-day involvement. A liability, conversely, is anything that takes money out of your pocket. It creates negative cash flow. Your car, your primary residence, your personal credit card debt, and any other possession that requires ongoing payment for maintenance, insurance, or interest is a liability. The profound simplicity of this rule is its power. Wealth is built not by a high income, but by the gap between the cash flow from your assets and the expenses from your liabilities. A high-income earner who spends everything on liabilities (a big mortgage, expensive cars, luxury goods) is poorer, in Kiyosaki’s view, than a moderate earner who diligently acquires income-generating assets. The wealthy focus on accumulating assets. The poor and middle class focus on their income statement (their job and expenses) and accumulate liabilities they think are assets. The path to becoming rich is therefore clear and methodical: relentlessly acquire and build assets that generate cash flow, and use that cash flow to fund your desired lifestyle, minimizing and delaying the acquisition of luxury liabilities.

“The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth in what seems to be an instant.” – Robert Kiyosaki The Robert Kiyosaki Philosophy

Why the Rich Don’t Work for Money

This provocative statement is a cornerstone of Kiyosaki’s philosophy. When he says the rich don’t work for money, he means they do not trade their time linearly for dollars as employees and self-employed individuals do. Instead, they focus on building or acquiring systems and assets that generate money for them. Their work is the intellectual work of solving problems, creating systems, finding opportunities, and allocating capital. Once the system or asset is in place, it works independently of their time. This is the concept of passive or residual income. The rich understand that time is their most limited resource, so they leverage other resources: other people’s time (in a business), other people’s money (through debt or investment), and assets that work 24/7. An employee works 40 hours a week for 40 hours of pay. A business owner or investor might work intensely for 1,000 hours to build a system or acquire an asset that then generates income for the next 10,000 hours without their direct involvement. The goal is to break the direct link between time and money. This is why Kiyosaki encourages people to “mind their own business”—not necessarily to quit their job immediately, short paragraph

The Robert Kiyosaki Philosophy but to start building an asset column outside of their profession. While you work your day job (for money), you should be spending your nights and weekends building your own asset base (your “business”)—whether that’s a side hustle, real estate investments, or developing a product. The ultimate aim is for the cash flow from your assets to exceed your living expenses, at which point you have achieved financial freedom and no longer need to work for money. You then work by choice, on projects you are passionate about. The Robert Kiyosaki Philosophy

The Role of Real Estate in the Kiyosaki Strategy

While Robert Kiyosaki advocates for multiple forms of investment, he holds a special affinity for real estate, often citing it as the foundational asset class for building wealth. His reasons are rooted in the unique financial advantages real estate can offer. First is the power of leverage. You can control a valuable, income-producing asset (a property) with a relatively small amount of your own capital (the down payment), using a bank’s money (the mortgage) to finance the rest. This amplifies your returns on investment. Second is cash flow. A well-chosen rental property should generate monthly income after all expenses, including the mortgage, are paid. This is pure asset behavior, putting money in your pocket. Third are tax advantages. In many jurisdictions, real estate investors can benefit from depreciation (a paper expense that shields cash flow from taxes), deductions for mortgage interest and operating expenses, and favorable capital gains treatment. Fourth is appreciation. Over time, properties tend to increase in value, building equity. Fifth is the element of control. Unlike stock in a public company, where you are a passive shareholder, with real estate you can actively increase its value and cash flow through improvements, better management, or adjusting rents. Kiyosaki teaches that understanding how to find, analyze, finance, and manage real estate is a quintessential skill for the “I” quadrant. It embodies the principles of using debt wisely, focusing on cash flow, and benefiting from legal tax strategies. He doesn’t suggest it’s easy or without risk, but presents it as a tangible, learnable path for the average person to begin building serious asset columns. The Robert Kiyosaki Philosophy

Real estate is often highlighted as a key asset class for building leveraged, cash-flowing wealth.short paragraph The Robert Kiyosaki Philosophy

Embracing Debt and Risk: A Controversial Pillar

Mainstream financial advice often preaches the gospel of being debt-free. Robert Kiyosaki offers a starkly different, often misunderstood, perspective: there is good debt and bad debt. Bad debt is consumer debt used to buy liabilities—credit card balances for vacations, clothes, or cars that depreciate. This debt drains your wealth. Good debt, however, is debt used to acquire income-generating assets. A mortgage on a rental property that pays for itself and generates profit is good debt. A business loan used to expand a profitable enterprise is good debt. This is the concept of leverage—using other people’s money (OPM) to accelerate your wealth building. short paragraph

The Robert Kiyosaki Philosophy The rich, Kiyosaki observes, are not afraid of debt; they master it as a tool. Similarly, his view on risk challenges conventional thinking. He distinguishes between being risky and being competent. The average person, lacking financial education, sees investing as risky. The financially literate person, however, undergoes training and gains experience to mitigate risk. They perform due diligence, understand the numbers, and build contingencies. What looks like a huge risk to an outsider is a calculated opportunity to the educated insider. Kiyosaki argues that the riskiest thing of all is actually playing it safe—relying solely on a job, a savings account, and a pension in a world of rapid economic change, inflation, and job disruption. True security comes not from avoiding risk, but from increasing your financial intelligence to the point where you can manage risk effectively and use tools like leverage to your advantage. This pillar of his philosophy is about shifting from a defensive, fear-based posture with money to an offensive, opportunity-based one. The Robert Kiyosaki Philosophy

The Lifelong Pursuit of Financial Education

For Kiyosaki, the journey to financial freedom is a journey of continuous learning. He posits that every dollar in your pocket is a “token” you receive for the financial knowledge you possess. If you want more tokens, you must expand your knowledge. This education is active, not passive. It goes beyond reading books (though that is a start) and involves seeking mentors, attending seminars, making small investments to gain experience, and analyzing real deals. He encourages people to join investment clubs, find a coach, and constantly study the areas of accounting, investing, markets, and law. This learning is focused on the right side of the Cashflow Quadrant—the skills of the B and I. It’s about learning to see opportunities where others see problems. For instance, while most people see a dilapidated house as a problem, a financially educated person sees a potential asset that can be renovated and rented for cash flow. This education also involves emotional intelligence—learning to manage fear and greed, which are the primary emotions that derail investors. Kiyosaki’s own game, Cashflow, was designed as an educational tool to provide risk-free practice in financial statement analysis and investment decision-making. The core message is that you are your most important asset, and your mind is your most powerful tool. Investing in your financial education provides the highest return on investment because it is the engine that will drive all your future wealth-building activities. It is the one investment that no one can take from you, and it compounds over a lifetime. The Robert Kiyosaki Philosophy

Taking Action: The Bridge from Knowledge to Wealth

All the knowledge in the world is useless without action. This is a constant refrain in Kiyosaki’s teachings. Many people get stuck in “analysis paralysis,” forever learning but never doing. The bridge between the left side and the right side of the quadrant is built with action, not just intention. Kiyosaki advocates for starting small and starting now. This could mean using a small amount of money to make your first investment, even if it’s just a single share of stock, to go through the emotional process. It could mean purchasing a small rental property, starting a side business on weekends, or attending a local real estate networking event. Action creates feedback. You will make mistakes, but as rich dad taught, “Mistakes are how we learn.” The key is to take calculated, educated steps, not reckless leaps. Set clear financial goals: a target for passive income from assets that would cover your expenses. Then, break that goal down into actionable steps—save a specific down payment, analyze five properties a week, read one finance book a month. Action builds confidence and compounds experience. Each small deal teaches you something that prepares you for a bigger one. Kiyosaki emphasizes that you don’t need to be perfect to start; you need to start to become better. The world is full of educated poor people—those with knowledge but without the courage, discipline, or willingness to act on it. The wealthy are those who have the knowledge and the temerity to put it into practice, to face their fears, and to learn from the inevitable stumbles along the way. The Robert Kiyosaki Philosophy Investor.gov

Conceptual imagery representing the step from planning to decisive action. short paragraph The Robert Kiyosaki Philosophy

Legacy and Lasting Impact of the Kiyosaki Doctrine

The legacy of Robert Kiyosaki is multifaceted and undeniable. He has democratized financial concepts that were once the purview of the wealthy and Wall Street, bringing discussions of cash flow, assets, and quadrants into mainstream conversation. He has empowered millions to question the standard script of “go to school, get a job, save, retire” and to consider alternative paths to security. His greatest impact may be in the emphasis on financial literacy as a form of empowerment. While his specific investment advice (particularly on precious metals and doom-and-gloom economic predictions) is often debated, his core philosophical framework—the mindset shift, the asset-liability model, the Cashflow Quadrant—remains a powerful and enduring lens through which to view personal finance. He has created a global community of individuals striving to move from E and S to B and I. Critics argue he oversimplifies, sells expensive seminars, and promotes a one-size-fits-all approach centered on real estate and network marketing. Supporters counter that he provides the essential mindset shift needed to even begin the wealth-building journey. Regardless of the critique, his work has sparked a vital conversation. It has forced people to look at their personal balance sheets, to think like business owners and investors, and to take responsibility for their financial education. The Kiyosaki doctrine, at its best, is a call to awake from financial complacency, to think critically, and to build a life of freedom not through luck or a high salary, but through intelligence, courage, and systematic action. That is a legacy that continues to resonate. The Robert Kiyosaki Philosophy

FAQs About Robert Kiyosaki

Q: Is Robert Kiyosaki a billionaire?

A: While Kiyosaki claims substantial wealth from his business empire (books, games, seminars, branding), his exact net worth is not publicly verified in the way of a publicly traded CEO. His wealth is derived from his “B quadrant” business assets—the Rich Dad company.

Q: Did Robert Kiyosaki’s “Rich Dad” actually exist?

A: This has been a subject of long-standing controversy. Kiyosaki has stated that “Rich Dad” is a composite figure representing the financial mentors and lessons he learned from several people in his life, not a single, literal individual.

Q: Do I need to quit my job to follow Kiyosaki’s advice?

A: Absolutely not. In fact, he advises against quitting your job prematurely. The strategy is often to use your job to provide capital and stability while you build your asset column (your “business”) on the side during your spare time.

https://searchoncemore.com/arif-habib-the-architect-of-pakistans-financial-landscape/